In the last 30 years, Vietnam has transformed from one of Asia’s poorest countries to an “emerging economy” and during that time food consumption, including that of meat, has grown significantly. While the typical Vietnamese meal used to be based on rice and vegetables and meat was only consumed on special occasions, it is now normal to have meat in every meal. Vietnamese now eat four times more meat than 30 years ago. In 2021, the pork consumption per capita in Vietnam amounted to about 26 kilograms. Demand is projected to continue increasing up to 37.5 kg by 2027 and should grow faster than local production. While some Vietnamese pork is exported to China, Hong Kong and Laos among others, the country should remain a net importer, at least in the short term. Currently, Brazil and Russia are Vietnam’s main suppliers of pork meat.

Vietnam is a significant player in the global pork market. Its production more than doubled between 1975 and 2000, and was again multiplied by more than 4 times in the next 20 years as a result of population growth, economic development and urbanization. Behind China, Vietnam ranks second in Asia and is in the top 10 globally in terms of pig meat produced. However, the Vietnamese swine industry has faced challenges in recent years, such as African Swine Fever (ASF) and the Covid-19 pandemic.

Multiple challenges

Since February 2019, ASF had a substantial impact on Vietnam’s pork industry. Before the outbreak, domestic production supplied over 95% of pork consumption. Within a few months, the disease had spread to 63 cities and provinces; about 6 million pigs (more than 20% of the total swine population) were culled or died from the disease between 2019 and 2021. More than 90% of outbreaks were observed in small- and medium-sized farms with poor biosecurity practices, and above one million farmers went out of business. However, since one year, AVAC Vietnam Joint Stock Company, a Vietnamese company belonging to AGROUP which also happens to distribute Tonisity’s products for swine, has been testing more than 700,000 doses of a vaccine against ASF in 32 provinces and cities. Trial results are very promising and demonstrate an efficacy rate of 95%, when administered to pigs between the ages of 8 and 10 weeks.

Like in other countries, ASF outbreaks in Vietnam accelerated the restructuring process of the pig industry, leading to the development of the commercial and modern pig farms and a reduction of the family owned, small ones. And, despite the difficulties, the ASF epidemic led to investments to improve the quality of farms in terms of size, genetics, technology, and biosecurity, leading to a better organized and more efficient industry. But, while the production is getting better organized, processing and marketing are not ready yet. Vietnam counts 1.300 large slaughterhouses, but they are mostly dealing with cattle and poultry. There are also 24,655 small-scale abattoirs, but less than 5,000 meet the requirements for hygiene and safety.

Vietnamese consumers are more and more concerned about health, origin, food safety, and responsible antibiotic use. Vietnam has one of the fastest growing middle class in the world, which will have increased by 36 million people by 2030. A higher demand for higher-quality, healthier, and more sustainable products is expected from that part of the population. This trend is already visible with the appearance of unique products, such as the “banana-fed pigs” from Bapi HAG, the “vegetarian pork” from BaF Meat, or the “herbal pork” proposed by SagriFood.

Also, the local authorities are starting to implement policies and regulations aiming to reduce pollution. According to a 2020 report from the Ministry of Agriculture and Rural Development, farmers are using about 30-40 litres of water per pig per day for cooling and cleaning, and swine farms generate 300 million cubic meters of dirty water pear year, producing almost 70% of the waste water generated by the Vietnamese livestock industry. According to the plan, in 2025, all livestock farms must be moved out of residential areas and grouped into dedicated zones if they want to continue their operations.

Another clear challenge for the Vietnamese swine industry has been the Covid-19 pandemic. In 2021, it seriously disrupted the pork supply chain, resulting in a sharp decline in pork demand and a drop in prices. Farmers were hopeful that once the lockdowns were lifted, pork prices would rebound. However, even if Vietnam returned to a “new normal,” the prices of pigs continued to decline. In July 2022, there was a brief price increase followed by another fall. The situation was also exacerbated by high feed prices.

Last but not least, Vietnam has to rely on grain imports, such as corn and wheat, to support its expanding meat production. It is actually the largest corn importer in Southeast Asia, and the fifth largest purchaser globally and its main suppliers of raw materials for animal feed are Argentina and Brazil. Vietnam is therefore dependant on global market prices and their recent fluctuation has caused higher production costs, eroding the earnings of businesses and cooperatives. Some leading local players, such as Hoa Phat Group, Dabaco, Masan, and BaF, have reported losses in the first quarter of 2023.

Industry structure

As of today, ASF is still affecting the Vietnamese swine industry. More than 100 cases have been reported in 2023, and every city or province in the country has recorded at least one case since 2019. The number of sows in Vietnam was close to 4 million in 2018, with about 83% of pig farms having 10 pigs or less. Depending on the source, in 2019 the sow population dropped between 35 and 45%. According to official data, in March 2023, Vietnam had a total population of 24.66 million pigs and the number of sows is estimated to be around 2.2 million heads.

The number of pig farms has dropped very fast in the last ten years: from 10 million it went down to 4 million before ASF. Three years later, there are 2 million pig farms in Vietnam. About 65% of the pigs are raised in South Vietnam and 35% in the North.

One of the characteristics of the Vietnamese swine industry is the important role played by foreign-invested enterprises (FIEs). In the past, FIEs were owning about 30 percent of the total pig population, leaving the remaining 70 percent to private households and Vietnamese enterprises. But in 2023, the FIEs’ market share has increased to 43 percent. The rest of the swine herd is shared between private households (38%) and Vietnamese enterprises (19%). That shift in ownership also has an impact on how pig prices are determined: private households are losing their power.

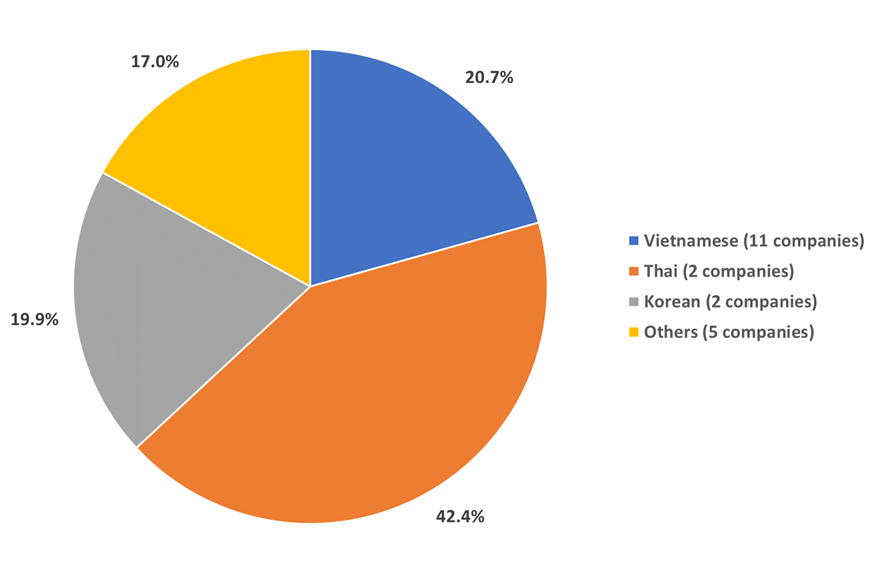

According to the data collected by the Tonisity team, if we consider the top 20 players, representing a sow population of about 700,000 heads, it appears that only 21% are owned by 11 Vietnamese enterprises (see Figure 1). This means that only 9 FIEs are holding more than half a million sows and they all belong to the top 10.

Figure 1: Distribution of the sow population among the top 20 players in Vietnam

Cost of production and prices

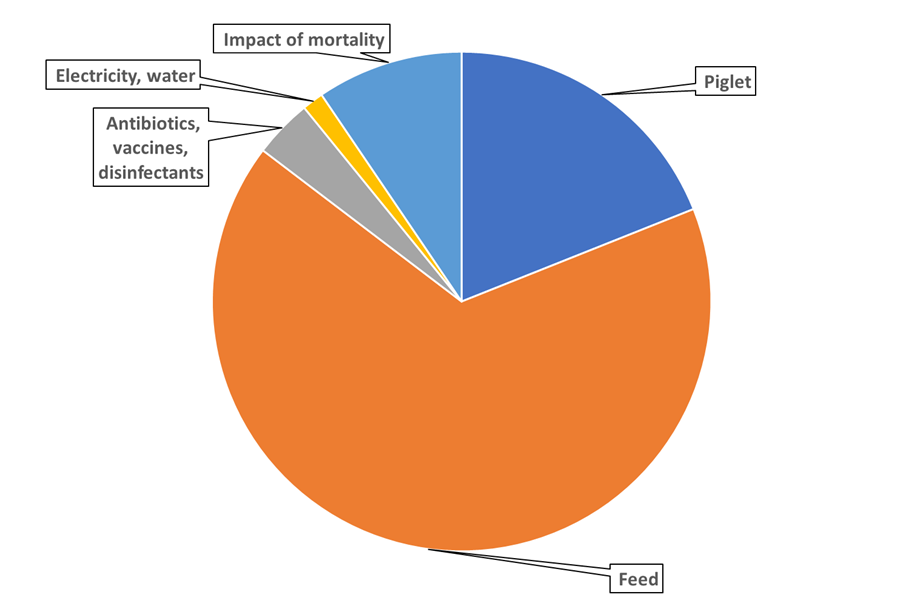

As shown in Figure 2, almost 70% of the cost of production of a pig ready for slaughter is feed. The total cost is about 48,000 VND per kg (1.9 € per kg). Large companies have additional costs (veterinarians, sales and marketing…) and their “management fee” increases the cost by about 10%.

It should be noted that almost 10% of the total cost is linked to losses caused by mortality. Unfortunately, this is in an “ideal” scenario. Outbreaks of ASF and Porcine Epidemic Diarrhoea (PED) mean that the loss can be much higher than that. In 2021 and 2022, outbreaks were mostly affecting small farms but now they also affect large farms. The mortality can reach 100% due to culling. Because of that factor, it is estimated that the average production cost of the smallholder farmers is ranging from 55,000 to 60,000 VND per kilo of pork.

Figure 2: Breakdown of the cost of production of a 120 kg liveweight pig in Vietnam (May 2023)

Beginning of 2023, the selling prices were below the cost of production and producers were losing money. The cost to produce one piglet was about 1.1 million VND, while piglet prices were less than 1 million. From November 2022 to January 2023, fattening pigs prices were around 48,000 VND/kg and from January to March they started to increase to around 51,000 VND – allowing for a very small profit in an “ideal” production scenario. Since April 2023, the prices have recovered. End of June, they are ranging from 60,000 to 63,000 VND per kg, depending on the area.

The outlook for the rest of the year is optimistic. Experts believe that feed costs will gradually decrease in the second half of 2023 and that efficient pig producers should be able to generate some decent margins this year. They anticipate that the average live hog price for 2023 will reach 59,000 VND per kilo, thanks to a reduced supply and a purchasing power which is increasing again, after the economy reopened.